Integrating Skip Pay BNPL payment method

Skip Pay provides the easiest and fastest integration of BNPL into your online store.

What is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is a payment method that allows customers to make purchases of goods or services and defer payment to a later date. This method enables customers to buy products immediately but delay the payment for a later time, often with no or low interest rates. Find out more about Skip Pay BNPL products

At Skip Pay, we believe that the payment process should be as simple and straightforward as possible, so that businesses can focus on what they do best: delivering high-quality products and services to their customers. With our advanced technology and easy-to-use platform, we are committed to providing businesses with the tools and support they need to succeed in today's fast-paced, digital marketplace.

Integrating Skip Pay BNPL is as easy as other payment methods

Integrating Skip Pay (BNPL) into your e-commerce store or payment system is just as simple as integrating any other non BNPL payment method.

Integration to your platform via REST API

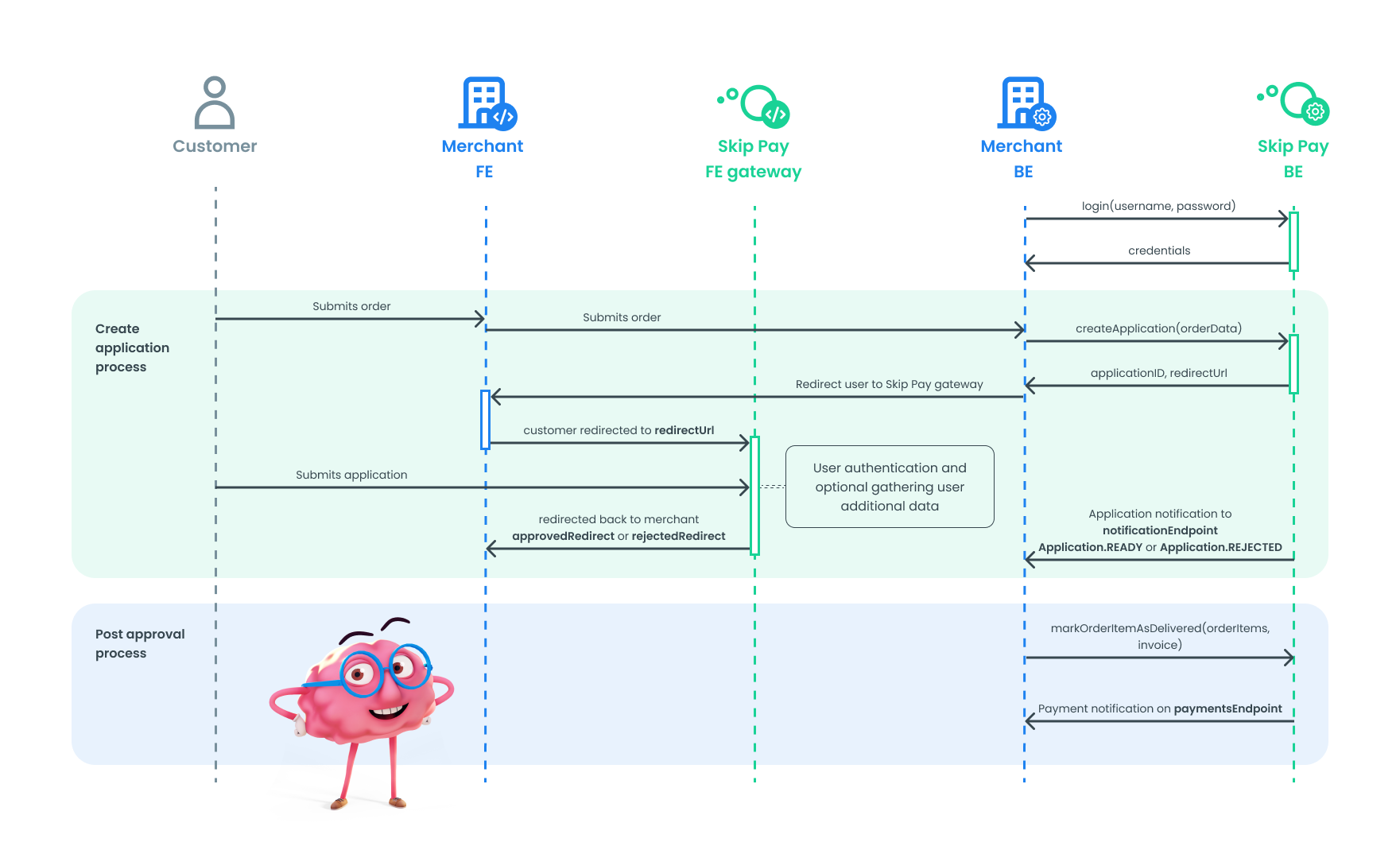

Follow the steps below to seamlessly integrate BNPL into your platform:

- Customer selects BNPL as the payment method: When a customer proceeds to checkout on your e-commerce store or payment system, offer them the option to pay using Skip Pay.

- Customer is redirected to the payment gateway: Once the customer selects BNPL, they will be redirected to Skip Pay's payment gateway, which handles BNPL transactions. Follow Guide: Create Applications for details on how to create a new BNPL transaction.

- Customer provides necessary details: The customer will provide the required information to complete the BNPL payment on payment gateway. This may include some personal details or other relevant data.

- Payment gateway processes the transaction: Skip Pay's payment gateway will verify the payment and approve or decline the application (transaction) based on internal validation checks. For details on how to retrieve application details, including payment status, refer to Guide: Manage Your Orders - Retrieve Application Details.

- Customer is redirected back to your store: After successfully completing the payment, the customer will be redirected back to your e-commerce store and receive a payment confirmation.

- Financial flows similar to conventional payments: The financial flows for BNPL payments are similar to other payment methods like card payments. As a merchant, you will receive the full payment upfront, and Skip Pay takes responsibility for managing any potential customer defaults. Additionally, the BNPL system allows for refund and cancellation processes as well. In the event of a refund, the funds are returned to the merchant instead of directly to the customer, ensuring a seamless refund experience. For information on how to proceed the payment, refund the payment or cancel the payment, see Guide: Create application and Guide: Manage Your Orders.

Integration using plugins or one-click-solutions

In addition to our REST API, we also offer integration with several popular platforms, such as Comgate, Fast Centrik, Shoptet and Shopty. These integrations are click-solutions that make it easy to start using Skip Pay on your website with minimal setup.

In addition to our REST API, we also offer integration with several popular platforms, such as Comgate, Fast Centrik, Shoptet and Shopty. These integrations are click-solutions that make it easy to start using Skip Pay on your website with minimal setup.

What services are we providing?

- Payment Processing: We provide a comprehensive suite of payment processing services, including BNPL (Buy Now Pay Later), to help businesses accept payments from their customers securely and efficiently. With our BNPL options, customers can purchase items they want and pay for them over time, giving them the flexibility to manage their finances while still enjoying their purchases. For more information see Guide: Create application and Guide: Manage Your Orders.

- Subscription Management: We offer a flexible subscription management system that allows businesses to set up recurring payments, manage customer accounts, and track subscription metrics all in one place. For more information see Recurring on demand.

- Payment Notifications: We use this resource to notify you about important changes within a particular application and related transactions. For example, if there is a new update, you will receive a notification. For more information see Webhooks and notifications - Application Notification and Webhooks and notifications - Payment Notification.

An application refers to the process by which a customer applies for financing through one of Skip Pay's payment methods. The elementary flow begins when the customer wants to use a Skip Pay payment method to finance their purchase from a partner e-shop.

Where to start?

Before you start the integration process, you have to register to get the necessary access and credentials for the Skip Pay API.

How does registration work?

- Contact us: Visit Skip Pay's website and fill out the registration form. You will be asked to provide personal information and indicate which of our services you are interested in, such as deferred payments, Pay in three, or both.

- Meet us: After you submit the registration form, Skip Pay will review your application and contact you to schedule a meeting to discuss your needs and answer any questions you may have.

- Discuss your needs: During the meeting, you will have the opportunity to discuss your business requirements and receive guidance on how to integrate Skip Pay's services into your website or application.

- Test it out: Once your application is approved, you will receive your credentials and access to our sandbox environment. This will allow you to test our services in a simulated environment before going live.

- Go live: After you have completed testing and are satisfied with the results, you can start using Skip Pay's services in a production environment to begin processing payments from your customers.

Need help?

If you have any questions or issues related to Skip Pay, you can get in touch with us using the following methods:

- Check out our FAQ section on our website, where we have compiled answers to the most commonly asked questions about Skip Pay.

- Send us an email at integrace@skippay.cz and we will get back to you as soon as possible with a solution to your problem.

- If you need immediate assistance, please call our support team at +420 226 288 700. We are available during our business hours and will be happy to help you.